The upcoming February review of the MSCI indices has Indian investors glued to their screens, eagerly anticipating potential tweaks to the composition of these influential benchmarks. Nuvama Alternative & Quantitative Research has released its predictions, identifying promising contenders for inclusion and outlining the hurdles some current constituents need to overcome to retain their spots. Let’s delve deeper into the specifics.

MSCI Smallcap Index: New Entrants Poised for Entry

Newly-listed IREDA, Cello World, Honasa Consumer Products, and Signature Global stand tall as top contenders for entry into the MSCI Smallcap index. Their stellar performances in the past three months, with rallies ranging from 10% to 100%, have significantly boosted their free float-adjusted market capitalizations, opening the door to inclusion. Nuvama estimates that IREDA’s inclusion alone could trigger $11 million in passive inflows, highlighting the significant impact these changes can have on individual stocks.

Joining the aforementioned quartet are other potential entrants like Jaiprakash Associates, RR Kabel, KPI Green Energy, Protean e-gov, Swan Energy, and J Kumar Infraprojects. Their inclusion hinges on the February 13th announcement by MSCI, with adjustments taking effect on February 29th.

MSCI Standard Index: Incumbents and Aspirants Await Reckoning

The battle for inclusion in the MSCI Standard index is equally captivating. Jindal Stainless, BHEL, Punjab National Bank, NMDC, and Oberoi Realty currently hold promising positions, poised for inclusion. Abhilash Pagaria, Head of Nuvama Alternative & Quantitative Research, estimates that their inclusion could translate to $130-150 million in passive inflows each, making it a highly coveted position.

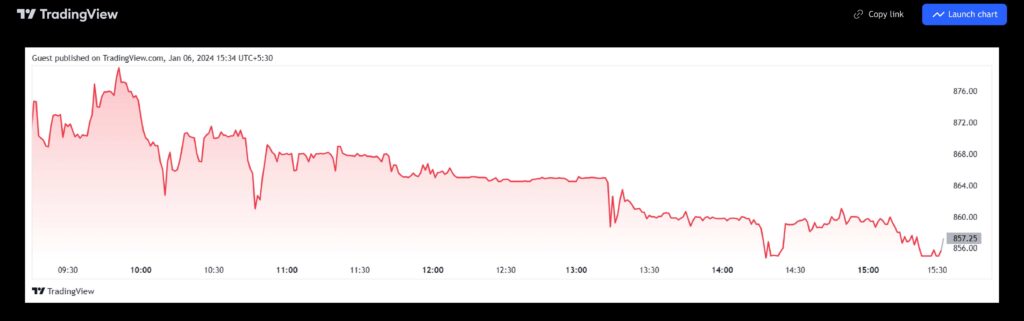

However, names like Alkem Labs, Prestige Estates, Union Bank of India, and Solar Industries face a slight uphill climb. They need to exhibit an additional 2-6% upward momentum from their current levels to secure their spots. Similarly, Dalmia Bharat, NHPC, GMR Airports, FSN E-Commerce Ventures, Canara Bank, Mankind Pharma, Bosch, and Vodafone Idea can join the ranks if they manage to rally by 8-20%.

For those falling short of the mark, a consolation lies in the May review. “If these stocks don’t see upside momentum before the Feb announcement, they can be strong candidates for the May review,” Pagaria added. The cut-off period for the February announcement runs from January 18th to 31st, leaving a crucial window for these contenders to demonstrate their potential.

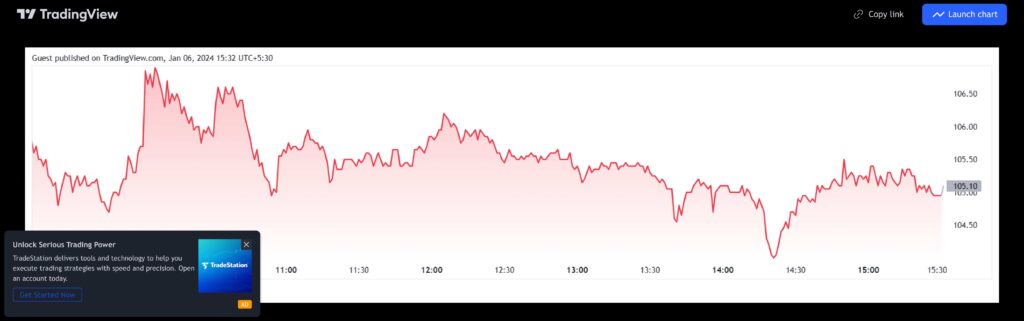

Exclusions a Possibility: Indraprastha Gas On Watch

The possibility of exclusions also adds an element of intrigue to the MSCI recalibration dance. Indraprastha Gas sits precariously close to the edge, facing the potential of dropping off the index if it dips 3-4% from its current market price. However, Nuvama currently deems it safe, leaving investors watching its trajectory with keen interest.

India’s Rising Stature in MSCI Indices

The upcoming MSCI reshuffle underscores India’s rising prominence in the global investment landscape. The country’s weightage in the MSCI emerging market index has witnessed a remarkable surge, climbing from 8% in October 2020 to 17.1% today. This impressive jump speaks volumes about the dynamism and attractiveness of Indian equities, attracting the attention of international investors.

The previous rejig further cemented India’s growing stature, with nine Indian stocks finding their way into the MSCI Standard Index. Names like IndusInd Bank, Suzlon Energy, Persistent Systems, and Paytm parent One97 Communications shone bright among the new entrants.

Beyond the Immediate Recalibration: Broader Implications for Indian Equities

The anticipation surrounding the MSCI recalibration extends beyond the immediate inclusions and exclusions. The event serves as a valuable barometer of investor sentiment towards specific sectors and individual companies. A stock’s inclusion signifies trust and recognition, potentially unlocking doors to larger pools of capital and boosting valuations. Conversely, exclusion can act as a dampener, impacting sentiment and liquidity.

Therefore, even companies not directly involved in the current reshuffle can glean valuable insights from the process. For investors, the MSCI announcements offer a crucial glimpse into the evolving dynamics of the Indian market, helping them refine their investment strategies and identify pockets of future growth.

1 thought on “Indian Equities Eye MSCI Recalibration: Potential Inclusions and Exclusions in Focus”