As the financial pulse of India, Mumbai’s banking scene paints a picture of a dynamic yet unbalanced landscape. While credit growth continues to soar, deposit growth lags behind, creating a widening chasm that raises concerns about the city’s long-term financial stability.

The Stark Divide:

According to the latest data from the Reserve Bank of India (RBI), Mumbai’s credit growth stands at a robust 19.93% year-on-year as of January 12, 2024. This indicates a thriving loan market, fueled by factors like healthier bank balance sheets and sustained demand for credit across various sectors. However, the story on the deposit side is starkly different. Deposits grew at a much slower pace of 12.84% y-o-y, leading to a significant gap of 7.09 percentage points between the two. This gap has widened further since September 2023, highlighting the growing disparity in Mumbai’s financial ecosystem.

Reasons for the Discrepancy:

Several factors contribute to this imbalanced growth:

- Competing Investment Avenues: Depositors are increasingly drawn towards alternative investment options like non-convertible debentures and equity markets, which currently offer potentially higher returns compared to bank deposits. This incentivizes individuals and institutions to park their funds elsewhere, impacting overall deposit growth in banks.

- Interest Rate Dynamics: Rising interest rates have indeed benefitted banks by improving their net interest margins (NIMs) as the transmission to asset yields has been faster than the rise in funding costs. However, the rate hike cycle also dampens investor appetite for long-term bank deposits, further widening the gap.

Convergence in the Long Run?

While the short-term disparity may raise concerns, historical data suggests a tendency for bank credit and deposit growth to converge over the long term. The RBI’s Financial Stability Report (FSR) points out an error correction mechanism where roughly 8% of the gap between credit and deposit growth gets eliminated every month. This implies a gradual narrowing of the current discrepancy, though it might take time to reach equilibrium.

Potential Challenges and Opportunities:

The widening gap poses several challenges for Mumbai’s financial system:

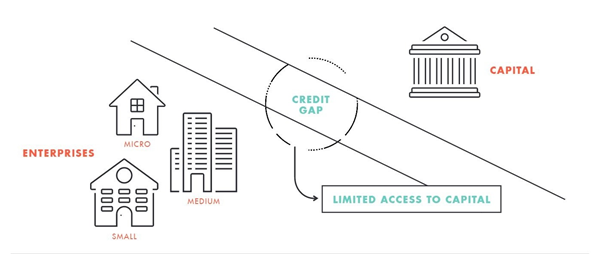

- Liquidity Constraints: Banks could face liquidity constraints if the gap persists, hindering their ability to meet the growing credit demand. This could eventually lead to higher lending rates and limit access to credit for certain sectors.

- Asset Quality Concerns: As banks compete for deposits, they might be tempted to offer higher interest rates or relax loan eligibility criteria. This could lead to the accumulation of bad loans in the long run, impacting asset quality and overall financial stability.

However, amidst these challenges, opportunities also exist:

- Developing Innovative Deposit Products: Banks can cater to the evolving needs of depositors by offering attractive and innovative deposit products tailored to specific risk appetites and return expectations. This could help bridge the gap and attract more funds into the banking system.

- Focus on Financial Inclusion: Expanding financial inclusion efforts and making banking services more accessible to underserved populations can lead to a broader pool of depositors, contributing to long-term deposit growth.

The Road Ahead: Mumbai’s banking landscape

Mumbai’s banking landscape requires proactive measures to address the widening gap between credit and deposit growth. The RBI, banks, and other financial institutions need to collaborate to create a sustainable environment that fosters both healthy credit expansion and robust deposit mobilization. This includes:

Also Read : Microsoft’s AI Gambit: Ascending the $3 Trillion Throne and Leading the Tech Charge

- Calibrating Monetary Policy: The RBI must carefully calibrate its monetary policy to ensure adequate liquidity without fueling excessive credit growth or hindering deposit inflows.

- Enhancing Financial Literacy: Promoting financial literacy among the public can help individuals make informed investment decisions and encourage them to utilize the safety and security of bank deposits.

- Strengthening Risk Management: Banks need to strengthen their risk management practices to ensure prudent lending and mitigate the potential for asset quality deterioration.

By addressing these challenges and capitalizing on the available opportunities, Mumbai can navigate the current financial landscape and build a robust and resilient banking system that caters to the needs of its diverse economy and population.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.