India, Asia’s oil guzzler, and Russia, the world’s ostracized crude kingpin, have found themselves in a complex oil tango. After the Ukraine invasion sent shivers through global energy markets, India emerged as a lifeline for Russian oil, snapping up discounted cargoes shunned by Western refiners. However, recent reports of a decline in Indian imports have sparked speculation about cracks in this oil-fueled alliance.

From Embrace to Hesitation: The Dance of Discounts

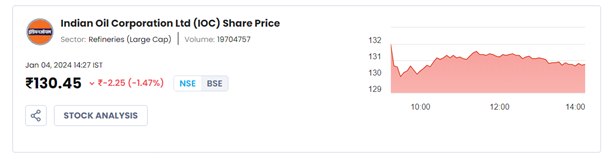

Initially, the dance was smooth. Lured by lucrative discounts on Urals crude, Indian refiners like Indian Oil Corporation and Nayara Energy flocked to Russian barrels. This surge not only provided relief to Moscow’s battered oil industry but also helped India secure its energy needs at advantageous prices. New Delhi defended its stance, citing its dependence on imported oil and arguing that its purchases remained within international law.

However, the rhythm began to falter in December 2023. Indian refiners, led by state-owned giants, noticeably scaled back their Russian purchases, with Sokol cargoes completely absent. Rumors swirled, attributing the drop to logistical snarls caused by the G7-imposed price cap on Russian oil. Others pointed to payment hurdles stemming from sanctions on Russian entities.

Oil Minister Puri Takes the Floor: Clarifying the Melody

Enter Hardeep Singh Puri, India’s oil minister, stepping onto the stage to set the record straight. In a recent press conference, he categorically denied any payment-related issues, asserting that the dip was purely a matter of economics. Indian refiners, he explained, were simply acting as savvy buyers, holding out for more attractive discounts before dipping their toes in the discounted Russian pool again.

This statement echoed India’s consistent refrain of prioritizing affordability for its energy-hungry population. Puri emphasized that India’s daily oil requirement stands at 5 million barrels, with Russia currently supplying around 1.5 million. This sizable dependence, he argued, underscored the absence of any payment bottlenecks.

Sanctions, Drones, and the Price Factor: A Tango with Complex Steps

While Puri dismissed payment issues, the elephant in the room remains the G7’s price cap on Russian oil. Though India isn’t officially bound by the cap, concerns about potential sanctions or unintended consequences could be dampening enthusiasm for Russian barrels. Additionally, recent drone attacks in the Red Sea, a crucial oil transport artery, raise logistical concerns that might further complicate the flow.

However, Puri portrayed these anxieties as minor distractions in India’s oil tango. He reaffirmed the country’s “buyer’s position” in the market, leveraging its significant demand to negotiate for the best deals on crude. This suggests that India won’t shy away from Russian oil if the discounts become alluring enough, regardless of external pressures.

The Future of the Tango: Harmony or Discord?

Predicting the next steps in this complex oil tango is no easy feat. Geopolitical tensions, fluctuating prices, and logistical challenges all play their part. But one thing is clear: India’s dependence on imported oil and its unwavering focus on affordability will continue to drive its oil diplomacy.

Also Read: Foreign Investors Embrace Indian Debt After Three Years of Outflows: A Deep Dive

While whispers of discord may fill the air, the potential for renewed harmony shouldn’t be discounted. If Russia offers India sufficiently enticing discounts, the two may well waltz back onto the oil stage, leaving the West to grapple with the implications of their energy tango.